The retirement planning process can feel overwhelming. For most people, the essential part of financial planning for retirees is determining the size of their nest egg and how long it may last as retirement income. You must also consider under which government-offered health insurance program you will manage your retirement healthcare expenses.

Will you enroll in Original Medicare or Medicare Advantage?

An Introduction to Medicare

Medicare is a federally subsidized healthcare program generally designed for individuals age 65 and older. Because most people get healthcare through their employer, Medicare is there to help retirees maintain coverage once they stop working. Unlike private healthcare plans, Medicare is only available for individuals (not couples). So, even if your spouse has a plan, you still have to sign up for yourself (and your plan can be different).

There are two main types of Medicare: Original and Medicare Advantage. Original Medicare is split into three parts (more on those later), and you can sign up for each part separately. With Medicare Advantage, you can bundle everything together into a single, streamlined plan. However, while this option may be more convenient, it also comes with more restrictions, such as which doctors you can see and how much your premium will be.

Although Medicare is designed to be affordable, it’s also limited. Now is the time to start thinking about saving for retirement healthcare expenses.

Understanding the Different Parts of Medicare

Medicare is broken into four sections: Part A, Part B, Part C, and Part D. There’s also another option called Medigap insurance to cover any gaps in your insurance. Here’s a quick overview of each section:

- Part A – Hospital Insurance: This section covers hospital visits, skilled nursing facility visits, and hospice care.

- Part B – Medical Insurance: This section covers doctor visits, home health care, medical equipment (e.g., walkers or wheelchairs), and preventative wellness visits.

- Part C – Medicare Advantage.

- Part D – Drug Coverage: This section covers the costs of prescriptions. If you have Original Medicare, you must sign up for Part D separately. If you have a Medicare Advantage plan (also known as Part C), drug coverage should be included, but with strict limitations and requirements.

- Medicare Supplemental Insurance (Medigap): Medigap coverage is provided by private health insurers and can enhance your overall plan benefits. A medigap plan is not a fit with and is not available for sale to those who enroll in Medicare Advantage.

So, which is better: Original Medicare or Medicare Advantage? If you’re relatively healthy and don’t need much coverage, an Advantage plan offers the coverage you generally need at no or lower premium than Original Medicare. However, if you’re worried about extended hospital stays, ER visits, or expensive drug prices, you may want to get an Original plan with supplemental insurance.

Common Medicare Questions

Before signing up for Medicare, it’s imperative to know as much about your coverage as possible. Here are some answers to frequently asked questions regarding Medicare.

How much does Medicare cost?

The cost of Medicare depends on the type of coverage you get, so it varies from one person to another. With Original Medicare, you don’t pay a premium for Part A insurance, but you must pay a premium for Part B (at least $174 in 2024). If you worked for ten years (40 quarters) and paid FICA (Social Security and Medicare) tax, you qualified for Medicare and will not need to pay Part A premium when retired.

How do I enroll in Medicare?

The Social Security Administration is the enrollment arm of Medicare so you’ll enroll through SSA at age 65 or whenever you stop using private health insurance through your employer. But it’s important to remember to notify Medicare (through SSA) at age 65 if you will not enroll in Medicare because you are still on a private health insurance plan. If you do not notify Medicare you may be penalized with higher costs for life.

Even though the Social Security Administration is the enrollment arm of Medicare you do not need to claim your Social Security retirement income benefit when you enroll in Medicare. You have the option to claim your Social Security benefit from ages 62-70 and the decision when to claim is entirely independent of the age 65 enrollment eligibility age for Medicare.

Medicare has a seven-month initial enrollment period when you turn 65. This period starts three months before you turn 65, the month you turn 65, and extends for three months after the month in which you turn 65. If you don’t enroll during this period, you’ll likely have to pay a late fee (penalty).

Can I have Medicare if I’m still working?

Many people choose to work past age 65 these days. In this case, you may consider enrolling in Medicare Part A and defer Part B. Why? Because most people qualify for Medicare given their long work history so they can enroll in Part A to have hospital coverage but defer enrollment in Part B (coverage for doctor visits) because their private/employer provided medical insurance covers that. If you notify Medicare within eight months of ending your private insurance after age 65 you can avoid the enrollment penalty.

Does my income affect my premiums?

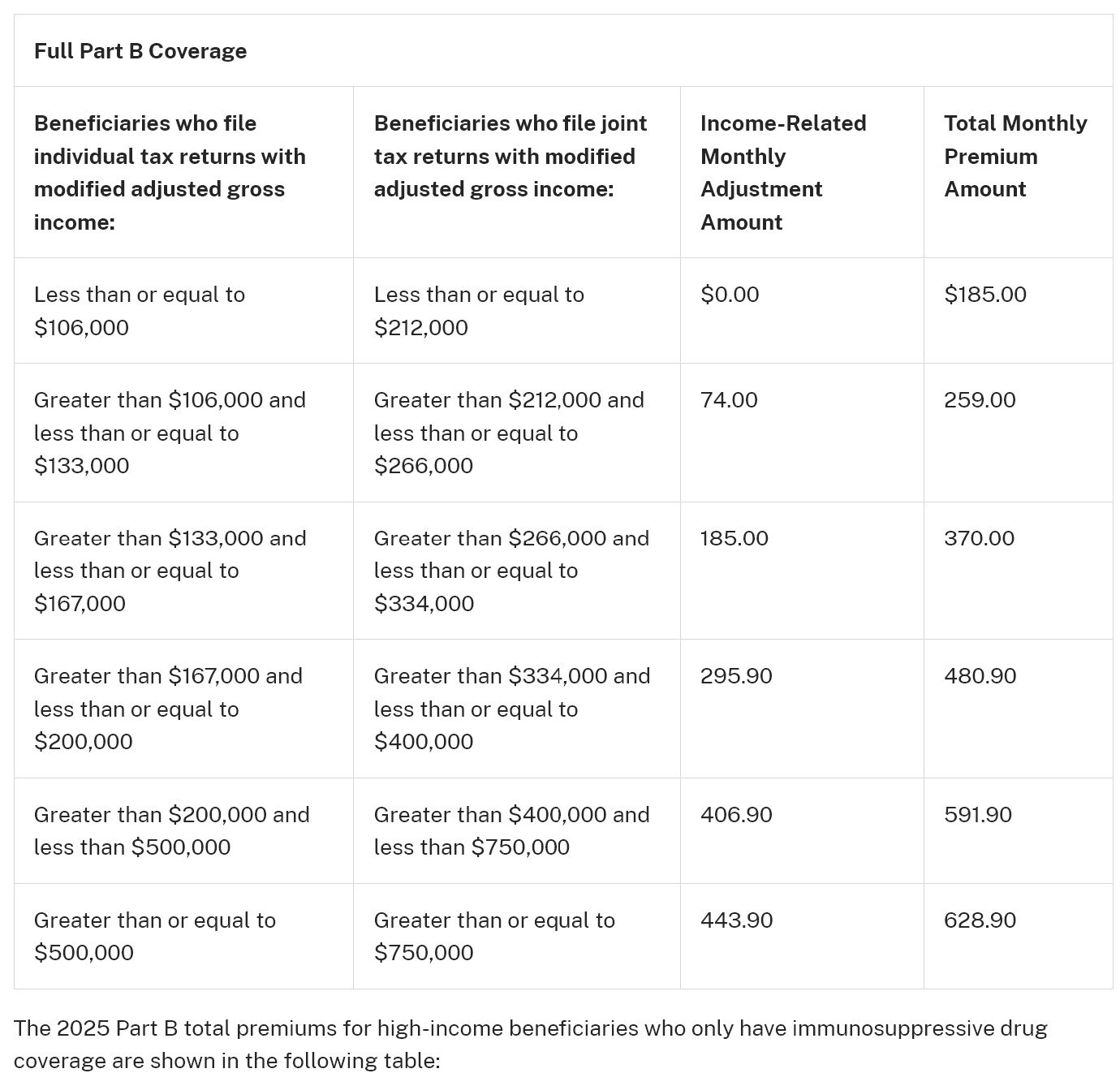

Yes, the more money you earn, the higher your premiums may be. Part B and D premiums include a surcharge if you earn above a certain limit. There are multiple tiers of surcharge as shown in the representative 2024 table below. Income Related Monthly Adjustment Amount (IRMAA) surcharges are based on your reported modified adjusted gross income (MAGI) two years prior.

The standard Part B premium in 2024 is $174.70. Both this and the IRMAA surcharges are indexed for inflation so expect them both to increase in 2025.

Retirement Advice – Saving for Medicare

Any comprehensive financial planning for retirees should include budgeting for healthcare expenses. According to recent data, retirees can expect to pay around $12,000 in their first year of retirement, and the costs will only go up from there.

One option to help offset projected health expenses in retirement is to open a health savings account (HSA) while you’re working. HSAs are tax-advantaged accounts that let you deduct contributions and make tax-free withdrawals for qualifying medical expenses. You can use that money while you’re enrolled in Medicare but you can’t continue to contribute to an HSA if you’re enrolled in Medicare. So, now is the time to open and fund an HSA, if you’re eligible. (Typically, HSAs are only available for those enrolled in a high-deductible healthcare plan.)

Enjoying a Long and Healthy Life

Don’t let Medicare intimidate you. Prepare for your retirement years by consulting a financial advisor/planner for personalized advice. A MyStages® retirement consultant can help you with all aspects of retirement planning strategies. Contact us today to put yourself on the path to a fruitful and relaxing retirement financial journey.